Quarterly Newsletter

Beyond one-size-fits-all: Eight custom features for state agencies

Adapting to unique needs with flexible customizations in Tyler Insurance Filings

Published: July 16, 2024

State agency offices handling insurance filings can significantly enhance their workflow and data accuracy through Tyler Insurance Filings' advanced customization capabilities. These tailored solutions streamline operations, reduce errors, and improve overall productivity, addressing the unique needs of state agencies effectively.

The following areas explore where government agencies have partnered with Tyler to implement customizations in Tyler Insurance Filings to meet unique filing requirements, increase staff productivity, and streamline agency operations.

Customizable data fields

With Tyler Insurance Filings, state agencies can collect specific data from filers, such as state-issued motor carrier numbers, insurance policy coverage limits, vehicle specific data, and operating authority details. These fields can be tailored to capture all necessary information precisely, ensuring that state-specific requirements are met accurately.

Validation rules and error messages

To maintain data integrity, Tyler Insurance Filings includes the ability to add validation rules and custom error messages to data fields. These rules ensure that all entered data adheres to the agency's business guidelines, reducing the likelihood of errors and enhancing the completeness and accuracy of filings.

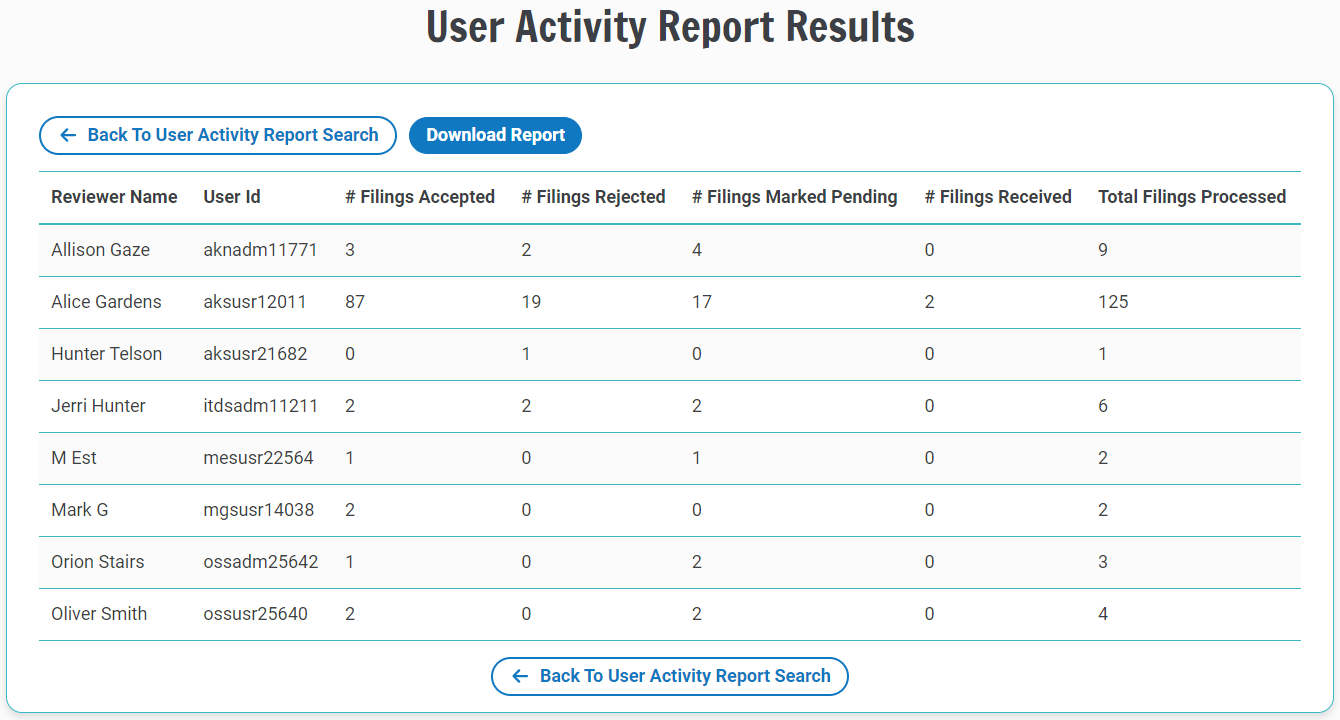

Custom filters and reporting

To facilitate easy data management and analysis, Tyler Insurance Filings offers custom filters and reports. Agencies can request to tailor these tools to track specific metrics, monitor filing status, and generate detailed reports that provide insights into operational trends and performance.

Adding data filters offers significant benefits by enabling reviewers to streamline their experience and focus on the most pertinent information, enhancing efficiency and productivity.

Kentucky suggested a User Activity Report for tracking staff progress. This report is now available for all agencies.

Automated filing acceptance or rejection

Our partner agencies can implement this feature to allow Tyler Insurance Filings to automatically accept or reject filings based on predefined criteria. This automation simplifies the review process, ensuring that only compliant filings are approved, thus saving valuable time and resources, reducing human errors, and minimizing manual intervention.

Integration with existing systems

Integration with Tyler Insurance Filings allows states to pull proof of insurance records into their internal systems and match these filings to data in the office's motor carrier permit application system. Integrations promote a streamlined data flow, reduce redundant data entry, and maintain data consistency across systems.

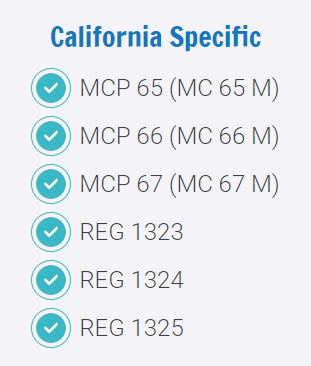

California has six state-specific forms available in Tyler Insurance Filings.

State-specific forms

Tyler Insurance Filings provides the flexibility to add custom, state-specific forms, e.g., California forms MCP 65 and MCP 66, for reporting certification of insurance to ensure that all necessary information is captured in the state's preferred format. This capability helps insurers comply with agency regulations and simplifies the filing process for users by providing clear, relevant forms tailored to the specific requirements of each state.

Personalize email messages and templates

Participating government agencies can customize email messages and templates, improving communication with insurance filers. With custom templates, agencies can deliver clear, consistent information aligned with agency protocols, directing filers to the agency's website or specific instructions, as needed. With personalized notifications, filers will receive pertinent updates, reminders, and notifications, facilitating a smoother filing process and improving overall compliance.

Tailored solutions for comprehensive workflow efficiency

Beyond the specific features already mentioned, Tyler Insurance Filings is designed to help state partners relieve workflow pain points. For example, we can provide a comprehensive view of filing history to track past submissions and ensure continuity in record-keeping. The system can also accommodate multiple authorized reviewers, ensuring filings are processed without delay if primary reviewers are on vacation or unavailable.

Our team is committed to working closely with state regulatory agencies to understand their unique needs and develop tailored solutions that enhance their operational efficiency. Whether it's integrating new functionalities, adjusting existing workflows, or creating new features, we are here to support our partners in achieving their goals.

State agency offices can greatly benefit from the tailored solutions offered by our system to optimize insurance filings. These capabilities help state agencies streamline their operations, maintain compliance, and effectively manage their workflows.

For more information and to discuss specific needs, please reach out to our customer service team at support@tylerinsurancefilings.com about available customizations.